The US has declared that starting on Tuesday, December 9, it will lower fixed rates for residential and buy-to-let properties in all of its New Business and Product Transfer categories by as much as 0.15%. The lender appears to begin 2026 with rates starting at 3.51%, a decrease of 0.56% from January 1, 2025, when its lowest on-sale rate was 4.07%, according to the most recent update, which comes after a series of decreases in November.

Rate reductions and improvements in affordability have made 2025 the year of the buyer, enabling more buyers to move up the property ladder or take their first step. With reductions across the board and our lowest on-sale rate of the year, we’re happy that our final rate change for 2025 will support purchasers into January as they embark on a new year, new house search.

Home relocators: The minimum loan amount is $500,000, and the new 60% and 75% LTV two and five-year fixed products start at 3.51% with a charge of $1,999.

Five-year fixed rates ranging from 3.65% to 75% to 90% LTV were lowered by up to 0.03%.

First-time purchasers: Starting at 4.06%, all 85% and 90% LTV two-year fixed rates were lowered by up to 0.15%.

With rates beginning at 4.19%, all 85% LTV five-year fixed rates were lowered by up to 0.05%.

Remortgage:

- The chosen between 60% and 90% LTV two-year fixed rates, which began at 3.69%, were lowered by as much as 0.07%.

- The chosen between 60% and 75% LTV three-year fixed rates, which began at 3.78%, were lowered by as much as 0.02%.

- 60% to 90% LTV five-year fixed rates that start at 3.71% and can be lowered by up to 0.12%

First-time buyer, new build:

- Starting at 4.06%, all 85% and 90% LTV two-year fixed rates were lowered by up to 0.15%.

- With rates beginning at 4.19%, all 85% LTV five-year fixed rates were lowered by up to 0.05%.

Us stated that it planned to start 2026 with rates as low as 3.51%, which would be a substantial decrease from the 4.07% rate it had in January. “2025 has been the year of the buyer, with rate reductions and affordability improvements helping more buyers take that first step onto or move up the property ladder,” stated Graham Sellar, head of Santander for Intermediaries. With reductions across the board and our lowest on-sale rate of the year, we’re happy that our final rate change for 2025 will support purchasers into January as they embark on a new year, new house search.

Despite the difficulties, 2025 saw a 9% increase in first-time buyer activity.

It’s crucial to keep in mind that many first-time buyers can still become homeowners despite the difficulties mentioned in our analysis.

In fact, our analysis has revealed positive market trends; this year, the proportion of our clients who are first-time purchasers has risen by 9 percentage points. Therefore, even while it may appear more difficult to become a homeowner than it was for earlier generations, many people can still achieve it, including you.

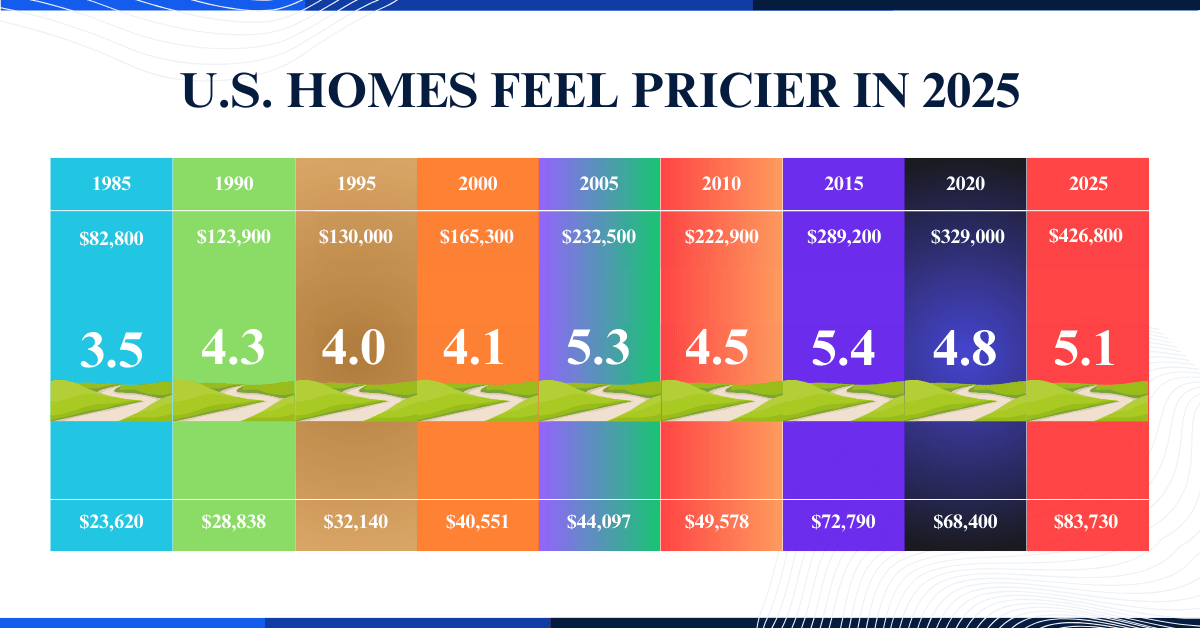

The startling difference between incomes and home values over the past 50 years

The path to homeownership has undergone a significant transformation over the past 50 years, as evidenced by the data. In 1975, a house could be bought for about $10,978, while the average pay for two people was $4,680.

In 2025, the average earnings for a couple have increased to $70,200 ($35,100 per person), yet the cost of a home has surged to $272,819. House prices have increased by more than 2,385%, but earnings have only increased by 1,400%.

For prospective homebuyers, what does this mean? Although earnings have clearly increased, they haven’t kept up with the rapid rise in home prices.

Final Thought

The lender appears to begin 2026 with rates starting at 3.51%, a decrease of 0.56% from January 1, 2025, when its lowest on-sale rate was 4.07%, according to the most recent update, which comes after a series of cuts in November.