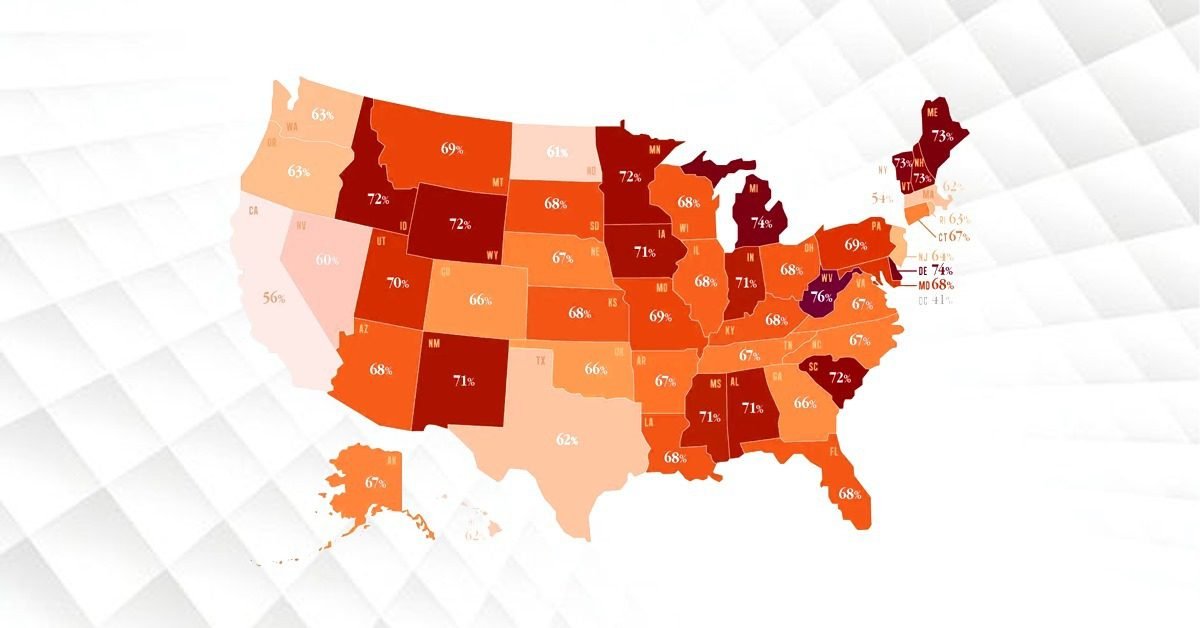

Homeownership is one of the most reliable methods to acquire wealth in the United States. According to a recent Credit Karma survey, U.S. homeowners have a median net worth that is 40 times that of renters. This map depicts homeownership rates throughout the states. West Virginia has the highest rate (77.8%), while New York has the lowest (53.6%). For years, ownership rates have been dropping in nearly every state. According to the Urban Institute, the rate will continue to fall as a result of a variety of political and economic barriers, excluding around 3.3 million households from the benefits of homeownership by 2040 who would otherwise have purchased homes.

Key Homeownership Statistics

- According to the U.S. Census Bureau, 65.1% of American homes are owned by their residents.

- 65.1% of Americans own their homes.

- New York (52.2%), California (55.3%), and Hawaii (60.6%) have the lowest homeownership percentages among states.

- Homeownership rates are greater among elderly Americans. 78.6% of people over the age of 65 own their homes, compared to 36.4% of those under 35.

What percentage of people own their homes?

As of the fourth quarter of 2025, 65.1% of American households owned their homes.

- In terms of foreign homeownership rates, the United States ranks in the center. Around the world, homeownership rates range from 60% to 90%.

- Laos (95.9%) and Romania (95.3%) are among the highest homeownership percentages in the world.

- Hong Kong (22.1%), Nigeria (25%), and the United Arab Emirates (28%) have some of the lowest homeownership rates in the world.

- Furthermore, American homeowners reside in their homes for an average of 11.8 years.

Homeownership rates by state

States with the lowest homeownership rates in the US include Hawaii (60.6%), California (55.3%), and New York (52.2%). These three states have historically had the highest average property prices in the United States.

- The Midwest has the highest percentage of homeowners in the United States (69.5%).

- 66.6% of people in the South are homeowners.

- The West (60.7%) and Northeast (61.4%) have lower rates of home ownership.

Demographics of Homeownership

Homeownership rates vary by demographic criteria such as gender, age, and ethnicity. Our analysis of the salary required to purchase a property in each state now takes income into account.

Rates of Homeownership by Age

As people get older, they are far more likely to be homeowners. For example, those over 65 are nearly twice as likely as those under 35 to be homeowners. This is a breakdown of homeownership by age group.

Rates of Homeownership by Ethnicity

74.4% of non-Hispanic White households are homeowners. The homeownership rates by ethnicity are fully broken down here.

Rates of Homeownership by Gender

Forty percent of men who have never married are homeowners. Compared to single women who own their homes 34% of the time, this is 6% greater.

Men and women who are divorced have similar numbers. 63% of divorced men and 62% of divorced women are likely to be homeowners.

Conclusion

Property ownership is accepted by about 65.1% of American households, indicating its importance in attaining stability and the “American Dream.”

Due to increased housing prices and living expenses in major metro regions from San Diego to San Francisco, there are clear regional differences, with the lowest ownership rates in New York, California, and Hawaii. The national homeownership rate has fluctuated between 63% and 69% since 1965, demonstrating the lasting attractiveness of property ownership in the face of shifting economic conditions.

FAQs

Q1: Which State Has the Highest Rate of Home Ownership?

With 77% of families owning a home in 2023, West Virginia had the highest homeownership rate.

Q2: What percentage of Americans own a home?

The 65.0 percent homeownership rate did not change statistically from the 65.6 percent rate in the second quarter of 2024 or the 65.1 percent rate in the first quarter of 2025.

Q3: What makes owning a home so crucial to the US economy?

The housing market has a substantial impact, accounting for about 12.3% of the GDP in the United States. Homeownership is a potent force behind economic growth, from generating jobs in manufacturing and construction to promoting local spending on products and services.

Q4: What is the typical duration of US homeownership?

The majority of Americans stay in their houses for fewer than 15 years.

Q5: A homeownership rate: what is it?

The percentage of owner-occupied households is known as the homeownership rate.